Pool Financing Options

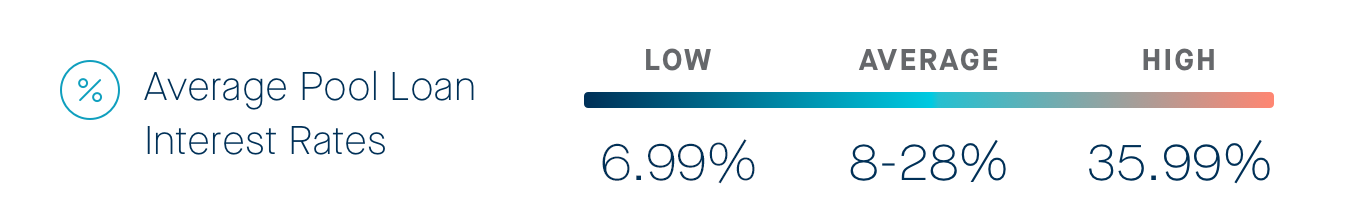

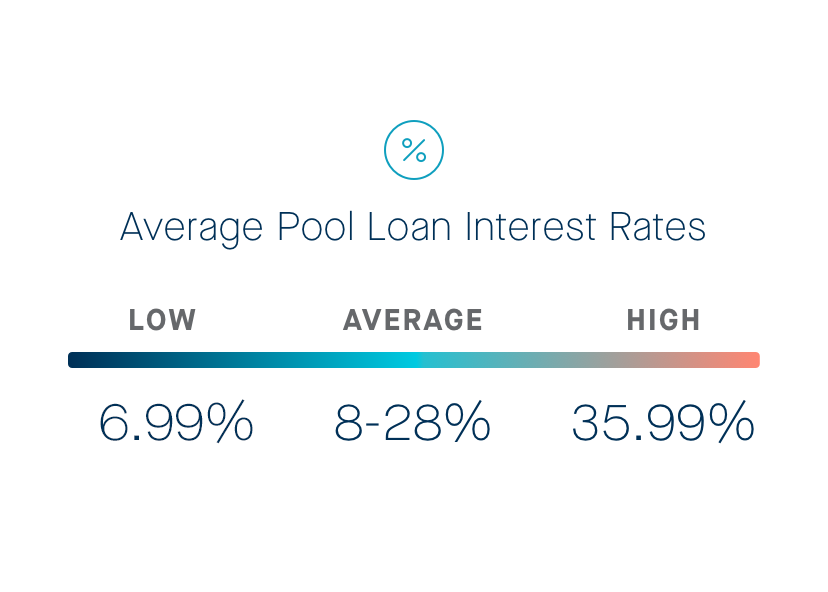

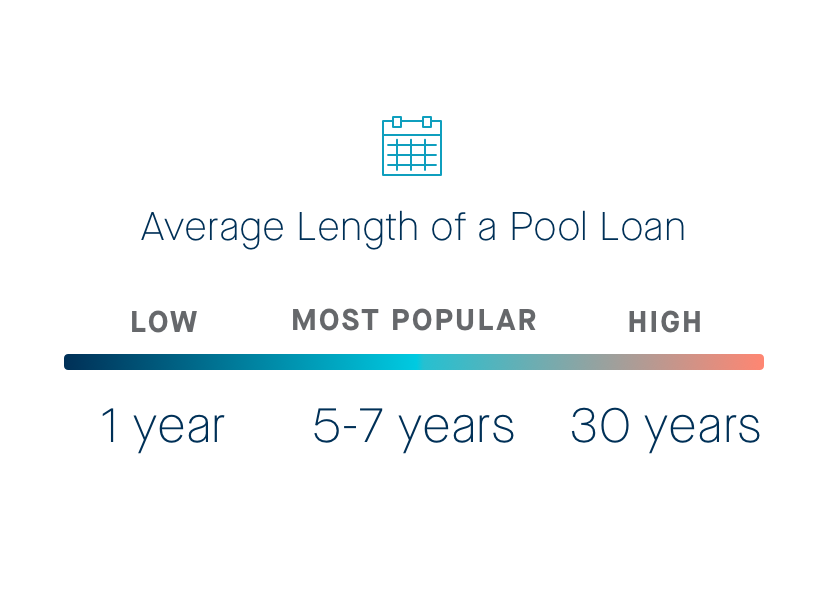

When researching the best way to finance a pool, the wide range of options available can seem overwhelming at first. But typically, there are three main categories of pool financing to be aware of: in-house pool loans, financing that leverages the equity in your home (like home equity loans or HELOCs), and personal loans.

Pool financing is not one-size-fits-all, which is why it is important to carefully consider the pros and cons of each to ultimately decide which type of financing best fits your needs.